What is Financial Therapy, and How Can It Support the Success of Small Businesses? QuickBooks Online!

Introduction: Understanding the Role of Financial Therapy for Small Businesses

Starting and managing a small business comes with its unique set of challenges, especially when it comes to financial matters. For many entrepreneurs, financial stress can take a toll on both their business and personal well-being. This is where the concept of financial therapy steps in, offering valuable support and guidance to navigate financial challenges effectively. In this article, we will delve deep into the world of financial therapy, its role in supporting small businesses, and how QuickBooks Online can complement these efforts. Let's explore the ins and outs of financial therapy and its impact on small business success.

|

| Financial Therapy For Small Businesses |

What is Financial Therapy, and How Can It Support the Success of Small Businesses?

At its core, financial therapy is the integration of therapeutic techniques and financial expertise to address and resolve financial issues on both personal and business levels. It recognizes that financial problems can have emotional and psychological implications, and thus, it aims to provide holistic solutions. By combining financial planning with emotional support, financial therapy helps individuals and business owners develop healthier relationships with money and make better financial decisions.

Understanding the Intersection of Psychology and Finances

Financial therapy operates on the premise that our attitudes, behaviors, and beliefs about money are deeply rooted in our psychology. Past experiences, upbringing, and cultural influences can significantly impact our financial decision-making processes. Therefore, financial therapists work to uncover the emotional factors that may be contributing to financial stress, and then they provide the tools and strategies to address these issues effectively.

Building a Strong Financial Foundation for Small Businesses

For small business owners, financial therapy can play a vital role in building a strong financial foundation. It can help entrepreneurs understand their financial goals, identify potential obstacles, and create a realistic business budget. Moreover, financial therapy assists in managing cash flow, optimizing expenses, and setting achievable financial targets. By fostering financial well-being, small businesses can thrive and achieve long-term success.

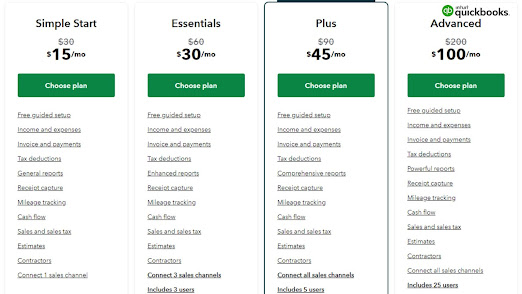

QuickBooks Online: A Powerful Tool for Financial Management

To complement the efforts of financial therapy, small businesses can leverage the power of QuickBooks Online. It is a cloud-based accounting software designed to simplify financial management for businesses of all sizes. With features like expense tracking, invoicing, and financial reporting, QuickBooks Online enables business owners to stay on top of their finances efficiently.

Harnessing Financial Data for Informed Decision-Making

One of the key benefits of using QuickBooks Online is its ability to generate real-time financial data and insights. These data-driven reports can provide small business owners with a comprehensive understanding of their financial health. With access to this valuable information, entrepreneurs can make informed decisions, identify areas for improvement, and seize growth opportunities.

The Importance of Financial Therapy for Small Business Owners

Running a small business can be overwhelming, and the constant financial pressure can lead to burnout and decreased productivity. Here's where financial therapy steps in to offer invaluable support:

1. Reducing Financial Stress and Anxiety

Financial therapy helps business owners identify the root causes of their financial stress and provides coping mechanisms to alleviate anxiety. By addressing these emotional factors, entrepreneurs can focus better on their business's growth and development.

2. Improving Communication and Decision-Making

Financial therapy fosters open and honest communication about money matters, both within the business and among business partners. Enhanced communication leads to better decision-making and financial planning.

3. Developing Healthy Financial Habits

With the guidance of a financial therapist, small business owners can develop healthy financial habits, such as budgeting, saving, and investing. These habits contribute to the long-term financial success of the business.

4. Overcoming Financial Obstacles

Every business faces financial obstacles at some point. Financial therapy equips entrepreneurs with the tools to overcome these challenges effectively, preventing potential crises.

5. Strengthening Resilience

Financial therapy builds resilience in business owners, enabling them to bounce back from financial setbacks and adapt to changing economic conditions.

6. Achieving Work-Life Balance

By addressing financial concerns, entrepreneurs can achieve a better work-life balance, leading to improved overall well-being.

Frequently Asked Questions (FAQs)

Q: How can financial therapy benefit my small business?

Financial therapy can benefit your small business by providing emotional support, helping you make better financial decisions, and fostering financial well-being.

Q: Is financial therapy only for struggling businesses?

No, financial therapy is beneficial for all businesses, regardless of their financial status. It can help strengthen financial practices and promote growth.

Q: Can I use QuickBooks Online for personal finances too?

Yes, QuickBooks Online can be used for personal finances as well. Its user-friendly interface makes it suitable for personal financial management.

Q: What are some signs that my business may need financial therapy?

If you experience constant financial stress, difficulty managing cash flow, or struggle with financial decision-making, it may be time to consider financial therapy.

Q: Is financial therapy a long-term commitment?

The duration of financial therapy depends on individual needs and goals. Some may benefit from short-term sessions, while others may prefer ongoing support.

Q: Can financial therapy improve my business's bottom line?

Yes, financial therapy can lead to improved financial practices, which can positively impact your business's bottom line over time.

Conclusion: Embracing Financial Therapy for Business Success

Financial therapy offers a unique and effective approach to tackle the financial challenges faced by small businesses. By recognizing the importance of psychological factors in financial decision-making, entrepreneurs can benefit from the guidance and support provided by financial therapists. Coupled with the powerful financial management capabilities of QuickBooks Online, small businesses can achieve financial well-being and pave the way for long-term success. Embrace financial therapy as a strategic tool to build a strong financial foundation and secure a prosperous future for your small business.

Comments

Post a Comment